Ongoing service

One of our core service principles is building long-term relationships. When you choose us to manage your investments, it is with the intention of developing a long-lasting relationship. We maintain this relationship with our ongoing service approach.

-

Ongoing service

Your client team will be able to help you with any queries you have as we work according to your agreed investment plan. We will continue to monitor your plans and manage areas such as capital gains planning, utilising investment allowances and providing up-to-date valuations.

-

Reviews

During the first review meeting, we will agree how often you would like to meet. This can vary from client to client and will be agreed in writing in our service agreement. It is a chance to take stock and for us to continue the discovery process. These reviews enable us to ensure that the current planning continues to be suitable, and identify whether any changes are required. If a meeting is required outside of the agreed review process, this will be included in the ongoing service we provide.

-

Confirmation of suitability

If we decide that the current planning meets your circumstances and objectives, we will provide you with a report confirming this ongoing suitability. If, however, we find through the review process that it is no longer the most suitable option for you, then we will issue updated advice to alter your planning in response to your changing circumstances

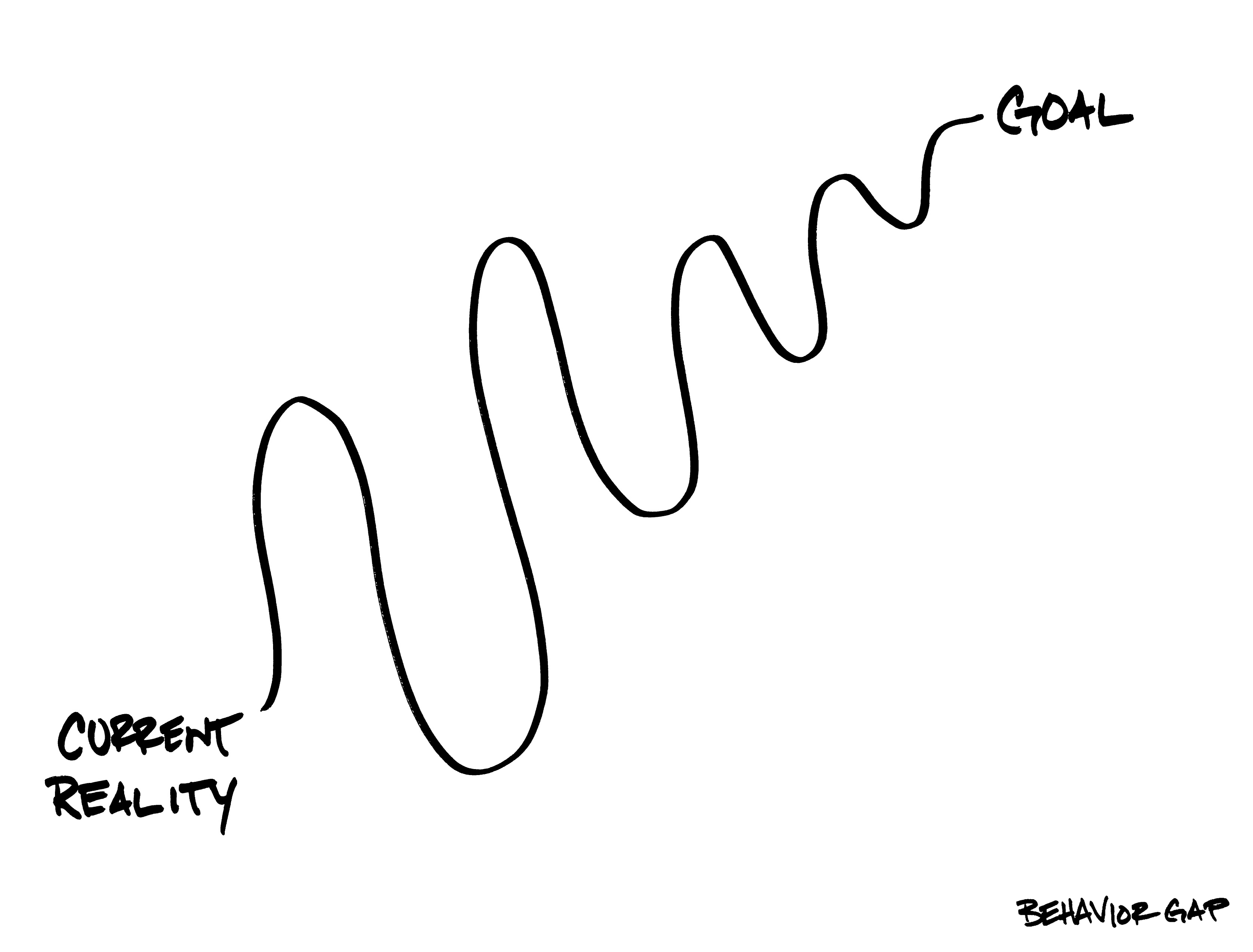

Current reality goal

The most important thing to understand about investing is that you do it in order to achieve a goal; not necessarily a financial one, but one which will need financial security.

The next important thing to understand is that there is rarely a straight path to achieving that goal. Your investments will go up and down in value and sometimes achieving that goal may feel far away. Your financial planner can help you to keep that goal in sight and help you to achieve it ensuring that despite the ups and downs.